Cryptocurrency regulation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In a world where digital currencies are reshaping financial markets, understanding how regulations impact this space is crucial.

As we delve deeper into the world of cryptocurrency regulation, we uncover the complexities, challenges, and opportunities that come with governing these virtual assets.

Overview of Cryptocurrency Regulation

Cryptocurrency regulation refers to the rules and guidelines set by governments and regulatory bodies to oversee the use of digital currencies in the financial market. These regulations are crucial to ensure transparency, security, and legality in the growing crypto industry.

Importance of Cryptocurrency Regulation

Regulating cryptocurrencies is essential to protect investors from fraud, money laundering, and other illicit activities. It also helps in fostering trust and confidence among users, leading to increased adoption of digital assets in the mainstream financial sector.

- Preventing Financial Crimes: Regulations help in combating illegal activities such as terrorism financing and money laundering through cryptocurrencies.

- Market Stability: By regulating the crypto market, authorities can prevent excessive speculation and ensure stability in prices.

- Consumer Protection: Regulations safeguard the interests of investors and consumers by enforcing standards for security and transparency.

Challenges of Regulating Cryptocurrencies

Regulating cryptocurrencies comes with its own set of challenges due to the decentralized nature of digital assets and the global reach of blockchain technology.

- Regulatory Divergence: Different countries have varying regulatory frameworks, making it difficult to establish uniform rules for cryptocurrencies on a global scale.

- Anonymity and Privacy Concerns: The pseudonymous nature of crypto transactions raises concerns about privacy violations and challenges in tracking illicit activities.

- Technological Complexity: Understanding the intricate workings of blockchain technology and cryptocurrencies is a challenge for regulators, leading to delays in formulating effective regulations.

Role of Governments and Regulatory Bodies

Governments and regulatory bodies play a crucial role in creating a conducive environment for the growth of cryptocurrencies while ensuring compliance with legal standards.

- Policy Formulation: Governments are responsible for drafting policies that balance innovation and consumer protection in the crypto market.

- Enforcement: Regulatory bodies enforce compliance with regulations, conduct audits, and impose penalties on entities violating the rules.

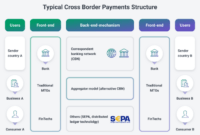

- International Cooperation: Collaboration between countries is essential to address cross-border challenges and harmonize cryptocurrency regulations globally.

Types of Cryptocurrency Regulations

Cryptocurrency regulations vary across different countries and regions, with governments adopting various approaches to manage the growth of this emerging financial sector. These regulations can range from outright bans to strict restrictions and licensing requirements, each impacting the cryptocurrency market in unique ways.

Regulatory Approaches

- Bans: Some countries have chosen to ban the use of cryptocurrencies altogether, citing concerns about fraud, money laundering, and the potential for destabilizing traditional financial systems.

- Restrictions: Other countries have imposed restrictions on the use of cryptocurrencies, such as limiting the types of transactions that can be conducted or requiring exchanges to adhere to specific guidelines.

- Licensing: In contrast, some countries have opted to regulate cryptocurrencies through licensing requirements for exchanges and other service providers, aiming to ensure transparency and accountability in the market.

Regional Contrasts

- Asia: Countries like Japan and South Korea have embraced cryptocurrencies with regulatory frameworks that provide clarity and support for the industry, leading to significant growth and adoption.

- Europe: The European Union has taken a more cautious approach, focusing on anti-money laundering regulations and consumer protection measures to mitigate risks associated with cryptocurrencies.

- North America: The United States has a patchwork of regulations at the federal and state levels, creating a complex regulatory environment that can be challenging for businesses operating in the cryptocurrency space.

Impact on the Market

- Successful Regulations: Effective regulations can enhance investor confidence, promote innovation, and drive mainstream adoption of cryptocurrencies, leading to a more robust and sustainable market ecosystem.

- Unsuccessful Regulations: Poorly designed regulations or overly restrictive measures can stifle growth, drive investment away, and hinder the development of the cryptocurrency market, creating uncertainty and volatility.

Compliance and Enforcement

Cryptocurrency regulations have introduced compliance requirements for individuals and businesses involved in dealing with digital assets. These requirements aim to ensure transparency, security, and accountability within the cryptocurrency ecosystem.

Compliance Requirements

- Verification of user identities: Individuals and businesses are often required to verify the identities of their customers to prevent fraudulent activities.

- Record-keeping: Keeping detailed records of transactions is essential to demonstrate compliance with regulations and facilitate audits.

- Reporting obligations: Reporting requirements may include disclosing transaction details to regulatory authorities to combat money laundering and terrorism financing.

- Compliance programs: Establishing compliance programs to monitor and enforce regulatory requirements within the organization.

Enforcement Mechanisms

- Regulatory oversight: Regulatory authorities monitor the activities of individuals and businesses in the cryptocurrency space to ensure compliance with regulations.

- Penalties and fines: Non-compliance with regulatory requirements can result in penalties, fines, or even legal action against offenders.

- Surveillance tools: Authorities may use surveillance tools and technologies to track transactions and identify suspicious activities in the cryptocurrency market.

Penalties for Non-Compliance

- Monetary fines: Individuals and businesses failing to comply with cryptocurrency regulations may face significant monetary fines.

- Legal action: Persistent non-compliance can lead to legal action, including lawsuits and criminal charges.

- Revocation of license: Regulatory authorities may revoke licenses or permits for businesses that repeatedly violate cryptocurrency regulations.

Challenges of Enforcement

- Decentralization: The decentralized nature of cryptocurrencies presents challenges in enforcing regulations, as there is no central authority overseeing the entire ecosystem.

- Anonymity: The anonymity associated with cryptocurrency transactions makes it difficult for regulators to identify and track individuals engaging in illegal activities.

- Cross-border transactions: Cryptocurrency transactions can occur across borders, making it challenging for regulators to enforce regulations that vary from country to country.

Future Trends in Cryptocurrency Regulation

As the cryptocurrency industry continues to evolve, it is crucial to consider the future trends in cryptocurrency regulation to understand how the landscape may change in the coming years.

Potential Impact of Emerging Technologies like Blockchain, Cryptocurrency regulation

Emerging technologies like blockchain have the potential to revolutionize the way cryptocurrencies are regulated. The transparency and security offered by blockchain technology could enhance regulatory efforts by providing a tamper-proof record of transactions. Regulators may leverage blockchain to streamline compliance processes and improve enforcement mechanisms.

Role of International Cooperation in Shaping Global Regulations

International cooperation will play a significant role in shaping global cryptocurrency regulations. With the borderless nature of cryptocurrencies, collaboration between countries is crucial to ensure consistent regulatory frameworks and prevent regulatory arbitrage. Organizations like the Financial Action Task Force (FATF) are already working towards creating international standards for regulating cryptocurrencies.

Balance Between Innovation and Regulation

One of the key challenges in cryptocurrency regulation is striking the right balance between fostering innovation and ensuring consumer protection. Overly restrictive regulations could stifle innovation in the industry, while inadequate regulations may expose consumers to risks. Regulators will need to find a middle ground that encourages innovation while safeguarding against potential harms.

As we conclude this exploration of cryptocurrency regulation, one thing is clear: the future of this evolving landscape holds both promise and uncertainty. Navigating the intricate web of regulations and innovations will be key to unlocking the full potential of cryptocurrencies in the global economy.

When checking the Bitcoin price today , it’s crucial to stay updated with the latest market trends. As for the top cryptocurrencies in 2024 , research and analysis play a key role in making informed decisions. Looking for the best cryptocurrencies to invest in ? Consider factors like market performance and potential growth for a successful investment strategy.

When it comes to Bitcoin price today , it’s essential to stay updated on the latest trends and fluctuations. Investors are constantly monitoring the market to make informed decisions.

Curious about the top cryptocurrencies of 2024 ? Explore the potential of these digital assets and stay ahead of the game by diversifying your investment portfolio.

Looking for the best cryptocurrencies to invest in ? Research and analyze the market to find promising options that align with your investment goals and risk tolerance.