Spot Forex trading explained: Dive into the world of foreign exchange trading as we unravel the complexities and strategies behind this dynamic market. From understanding currency pairs to analyzing charts and technical indicators, this guide will equip you with the knowledge needed to navigate the Spot Forex market with confidence.

Introduction to Spot Forex Trading

Spot Forex trading refers to the buying and selling of currency pairs at the current exchange rate. Unlike other forms of trading, such as futures or options, Spot Forex trading involves the immediate exchange of currencies, with transactions settled “on the spot” within two business days.

Currencies commonly traded in the Spot Forex market

In the Spot Forex market, traders commonly trade major currency pairs such as EUR/USD, USD/JPY, GBP/USD, and AUD/USD. These pairs are known for their high liquidity and are often favored by both beginner and experienced traders for their stability and predictability.

Mechanics of Spot Forex Trading: Spot Forex Trading Explained

When it comes to executing a Spot Forex trade, it involves the simultaneous buying of one currency and selling of another at the current exchange rate. This is known as a currency pair, where the first listed currency is the base currency and the second is the quote currency.

Currency Pair Quotations, Spot Forex trading explained

In the Spot Forex market, currency pairs are quoted with a bid price and an ask price. The bid price represents the maximum price that a buyer is willing to pay for the base currency, while the ask price is the minimum price that a seller is willing to accept for the base currency. The difference between the bid and ask price is known as the spread.

- When a trader initiates a buy trade, they do so at the ask price.

- When a trader initiates a sell trade, they do so at the bid price.

Role of Leverage

Leverage is a key aspect of Spot Forex trading, allowing traders to control a larger position size with a smaller amount of capital. It essentially magnifies both profits and losses. For example, a leverage of 1:50 means that for every $1 in the trading account, the trader can control $50 in the market.

It’s important for traders to use leverage wisely and manage risk effectively to avoid large losses.

Factors Influencing Spot Forex Prices

Spot Forex prices are influenced by a variety of factors that can impact the value of currencies in the market. Understanding these key factors is crucial for successful trading.

When it comes to crypto tax implications , it’s important to understand the potential impact on your investments. Whether you’re trading or holding digital assets, knowing the tax laws can help you avoid any surprises come tax season.

Economic Indicators and Geopolitical Events

Economic indicators such as GDP growth, inflation rates, and employment data can have a significant impact on currency values. Positive economic data usually strengthens a country’s currency, while negative data can lead to depreciation. Geopolitical events such as elections, wars, and trade agreements also play a crucial role in shaping currency prices as they can create uncertainty in the market.

Understanding crypto liquidity is crucial for anyone involved in the cryptocurrency market. Liquidity refers to how easily an asset can be bought or sold without causing a significant change in its price. This can greatly affect the efficiency of trading and the overall market stability.

Supply and Demand in the Spot Forex Market

- Supply and demand dynamics are fundamental to understanding how currency prices are determined in the Spot Forex market.

- When there is high demand for a particular currency, its value tends to increase as buyers are willing to pay more for it.

- Conversely, if there is an oversupply of a currency in the market, its value may decrease due to lower demand.

- Factors such as interest rates, economic performance, and political stability can influence supply and demand levels for currencies.

Risk Management in Spot Forex Trading

Effective risk management is crucial for success in Spot Forex trading. Traders need to implement strategies to protect their capital and minimize losses. In this section, we will discuss common risk management techniques used by Spot Forex traders and the importance of setting stop-loss and take-profit orders.

Common Risk Management Strategies

- Position Sizing: Traders should determine the appropriate position size based on their risk tolerance and account size. This helps in controlling the amount of capital at risk in each trade.

- Diversification: Spreading out trades across different currency pairs can help reduce overall risk exposure.

- Setting Stop-Loss Orders: Stop-loss orders are essential to limit potential losses by automatically closing a trade at a predetermined price level.

Importance of Setting Stop-Loss and Take-Profit Orders

- Stop-loss orders help traders define their risk and protect their capital from significant losses in case the market moves against their position.

- Take-profit orders allow traders to lock in profits by automatically closing a trade at a predefined price target.

- By setting both stop-loss and take-profit orders, traders can effectively manage risk and ensure disciplined trading.

Managing Leverage Effectively

- Using leverage magnifies both profits and losses in Spot Forex trading. Traders must understand the risks associated with leverage and use it judiciously.

- It is important to set leverage ratios that align with risk tolerance and avoid overleveraging, which can lead to significant losses.

- Traders should always consider the impact of leverage on their trading strategy and ensure they have sufficient margin to withstand adverse market movements.

Analyzing Charts and Technical Indicators in Spot Forex Trading

Technical analysis tools play a crucial role in Spot Forex trading, helping traders make informed decisions based on historical price movements and patterns. By analyzing charts and using various technical indicators, traders can identify potential entry and exit points, as well as predict future price movements.

Interpreting Chart Patterns

Support and resistance levels are key chart patterns that traders often look for when analyzing Spot Forex charts. Support levels indicate a price point where a currency pair is likely to stop falling and reverse, while resistance levels signal a point where the pair is likely to stop rising and pull back. These patterns can help traders determine optimal entry and exit points for their trades.

Significance of Technical Indicators

Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), are commonly used in Spot Forex trading to identify trends and potential trend reversals. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, helping traders gauge overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) is another popular indicator that combines moving averages to generate buy or sell signals.

- Moving averages help smooth out price data and provide a clearer picture of the trend direction.

- RSI helps traders identify potential trend reversals and overbought/oversold conditions.

- MACD can signal changes in trend momentum and provide buy or sell signals.

Fundamental Analysis in Spot Forex Trading

Fundamental analysis plays a crucial role in Spot Forex trading as it involves analyzing various economic indicators and factors that can influence currency prices in the foreign exchange market.

Economic Data Releases Impact

- Economic data releases such as GDP growth, employment reports, inflation rates, and trade balances can have a significant impact on currency prices.

- Traders closely monitor these economic indicators to assess the health of a country’s economy and make informed trading decisions.

- Positive economic data can strengthen a currency, while negative data can lead to depreciation.

Monitoring Central Bank Policies and Interest Rates

- Central bank policies and interest rates are key factors in determining a currency’s value in the Forex market.

- Changes in interest rates by central banks can lead to shifts in currency prices as higher interest rates typically attract foreign investment.

- Traders keep a close eye on central bank statements and decisions to gauge the future direction of a currency’s value.

Trading Strategies in Spot Forex Trading

When it comes to Spot Forex trading, having a solid trading strategy is essential for success. Traders utilize various approaches to capitalize on market opportunities and manage risks effectively. Let’s explore some popular trading strategies used by Spot Forex traders and compare different trading styles in the market.

Day Trading

Day trading involves executing trades within the same trading day, aiming to profit from short-term price movements. Day traders closely monitor the market throughout the day and often make multiple trades to capitalize on intraday fluctuations. This strategy requires quick decision-making and a high level of focus.

- Pros:

- Opportunity to profit from short-term price movements

- No overnight exposure to market risks

- Cons:

- High-frequency trading can lead to increased transaction costs

- Requires significant time commitment

Swing Trading

Swing trading involves holding positions for several days to weeks, aiming to capture medium-term price trends. Swing traders focus on identifying potential reversal points or breakouts in the market to enter and exit trades. This strategy requires patience and the ability to ride out short-term fluctuations.

- Pros:

- Potential for larger profits compared to day trading

- Less time-intensive than day trading

- Cons:

- Exposure to overnight market risks

- Requires more extensive market analysis

Position Trading

Position trading involves holding trades for weeks to months, focusing on long-term market trends. Position traders aim to capitalize on significant price movements and typically have a more relaxed approach to trading. This strategy requires a broader perspective on the market and the ability to withstand extended drawdowns.

- Pros:

- Potential for capturing major market trends

- Less time-sensitive than day or swing trading

- Cons:

- Higher risk exposure due to longer holding periods

- Requires patience to wait for trades to unfold

Automated Trading Systems

Automated trading systems, also known as algorithmic trading, involve using computer programs to execute trades based on predefined criteria. These systems can analyze market data and execute trades at high speeds, removing emotional biases from trading decisions. While automated trading can offer efficiency and consistency, it also comes with certain risks, such as technical failures or unexpected market conditions.

- Pros:

- Ability to execute trades without emotional interference

- Operates 24/7, allowing for round-the-clock trading

- Cons:

- Dependence on technical infrastructure and connectivity

- Potential for losses in volatile market conditions

Psychology of Trading in Spot Forex

The psychology of trading in the Spot Forex market plays a crucial role in determining success. Emotions and behavioral biases can often cloud judgment and lead to poor decision-making. It is essential for traders to understand these psychological aspects to navigate the market effectively.

Common Behavioral Biases in Spot Forex Trading

- Overconfidence Bias: Traders may overestimate their abilities and take unnecessary risks, leading to losses.

- Loss Aversion: The fear of losing money can prevent traders from closing losing positions, hoping for a turnaround.

- Confirmation Bias: Traders tend to seek information that confirms their existing beliefs, ignoring contradictory evidence.

- Herding Behavior: Following the actions of the crowd without independent analysis can result in poor trading decisions.

Tips to Overcome Emotional Trading Pitfalls

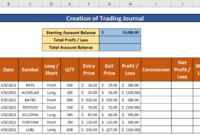

- Maintain a Trading Journal: Keeping a record of trades and emotions can help identify patterns and improve decision-making.

- Stick to a Trading Plan: Having a clear strategy in place and following it diligently can prevent impulsive decisions based on emotions.

- Practice Patience: Avoid rushing into trades out of fear of missing out and wait for the right opportunities.

- Utilize Stop-Loss Orders: Setting predetermined stop-loss levels can help limit losses and prevent emotional decision-making during volatile market conditions.

Maintaining Discipline in Spot Forex Trading

- Establish Clear Rules: Define your trading rules and stick to them consistently to avoid emotional deviations.

- Take Breaks: Stepping away from the screen during stressful periods can help clear your mind and prevent impulsive decisions.

- Seek Mentorship: Learning from experienced traders or seeking professional guidance can provide valuable insights and accountability in maintaining discipline.

In conclusion, Spot Forex trading is a multifaceted arena that requires a blend of technical analysis, fundamental understanding, risk management, and psychological discipline. By mastering the concepts discussed in this guide, traders can approach the market with a well-rounded strategy and a deeper insight into the factors driving currency prices.

With the rise of cryptocurrencies, cross-border payments with crypto have become more popular. This method allows for faster and cheaper transactions compared to traditional banking systems. It also eliminates the need for currency conversion, making it ideal for international transactions.