Range trading strategy in Forex takes center stage with a practical approach to trading within specified price ranges. Dive into this comprehensive guide to enhance your trading skills in the Forex market.

This guide will cover everything you need to know about identifying range-bound markets, developing a solid trading plan, utilizing technical and fundamental analysis, and optimizing your strategies for success.

Introduction to Range Trading Strategy in Forex

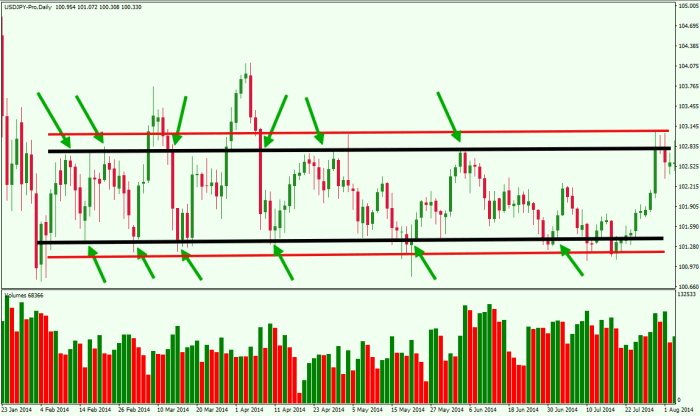

Range trading in Forex refers to a trading strategy where traders aim to profit from the price movements within a defined price range. This strategy involves identifying areas of support and resistance where the price tends to fluctuate without breaking out.

Knowing the major currency pairs in Forex is essential for any trader looking to navigate the market successfully. These pairs, such as EUR/USD and GBP/USD, are the most traded and offer high liquidity and tight spreads. To learn more about the most popular currency pairs in Forex, visit our article on major currency pairs in Forex.

Concept of Trading Within a Defined Price Range

When traders employ a range trading strategy, they typically buy at the lower end of the range and sell at the upper end. This means that they are looking to capitalize on the price movements within a specific range, rather than trying to predict the direction of the overall trend.

When trading Forex, understanding how to use support and resistance levels is crucial for making informed decisions. By identifying these key levels, traders can anticipate potential price movements and set entry and exit points more effectively. For a detailed guide on how to use support and resistance in Forex , check out our comprehensive article.

Importance of Range Trading in Forex Markets

- Helps identify potential entry and exit points: Range trading allows traders to pinpoint specific levels where they can enter trades and set profit targets.

- Minimizes risk: By trading within a defined range, traders can set stop-loss orders more effectively to manage risk.

- Suitable for ranging markets: In markets that lack a clear trend, range trading can be a profitable strategy as it takes advantage of price oscillations.

Identifying Range-Bound Markets

When trading in the Forex market, it is crucial to be able to identify range-bound conditions in order to implement a successful range trading strategy. Range-bound markets are characterized by price movements that trade within a specific price range without making significant upward or downward trends.

Key Indicators and Tools

One of the key indicators used to recognize range-bound markets is the Relative Strength Index (RSI). The RSI helps traders identify overbought and oversold conditions, which can signal potential reversal points within a range-bound market.

Another important tool is Bollinger Bands, which consist of a simple moving average and two standard deviations plotted above and below the moving average. When the price action moves towards the upper or lower bands, it may suggest that the market is in a range-bound phase.

Currency Pairs Suitable for Range Trading

Some of the currency pairs commonly suitable for range trading include:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

These pairs are known for their tendency to trade within specific price ranges, making them ideal for range trading strategies.

Developing a Range Trading Strategy

When creating a range trading plan in Forex, it is essential to follow a structured approach to maximize potential profits and minimize risks. Below are the steps to develop a successful range trading strategy:

Identify Key Support and Resistance Levels

- Start by identifying the key support and resistance levels within the range-bound market. These levels will help you determine the boundaries within which the price is likely to fluctuate.

- Use technical analysis tools such as trend lines, moving averages, and Fibonacci retracement levels to pinpoint these crucial price levels.

Set Clear Entry and Exit Points

- Establish clear entry and exit points based on the identified support and resistance levels. This will help you make informed trading decisions and avoid emotional reactions during volatile market conditions.

- Consider using limit orders to enter trades at specific price points within the range and set stop-loss orders to limit potential losses.

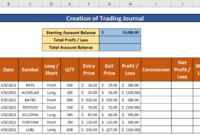

Implement Risk Management Techniques

- Implement proper risk management techniques specific to range trading to protect your capital and preserve your trading account.

- Set a risk-reward ratio for each trade to ensure that potential profits outweigh potential losses. Consider risking only a small percentage of your trading account on each trade.

Monitor Market Conditions

- Regularly monitor market conditions and price movements within the range-bound market to make necessary adjustments to your trading strategy.

- Stay updated on economic events, news releases, and technical indicators that could impact price movements within the range.

Technical Analysis for Range Trading

When it comes to range trading in Forex, technical analysis plays a crucial role in helping traders identify potential entry and exit points within a range-bound market. By utilizing various technical indicators and chart patterns, traders can make informed decisions and capitalize on price movements within a specific range.

Technical Indicators for Range Trading

- Moving Averages: Traders often use moving averages to identify key support and resistance levels within a range. The crossover of short-term and long-term moving averages can signal potential entry or exit points.

- Relative Strength Index (RSI): RSI is a momentum oscillator that can help traders determine overbought or oversold conditions within a range. When RSI reaches extreme levels, it may indicate a reversal is imminent.

- Bollinger Bands: Bollinger Bands can be used to identify the upper and lower boundaries of a range. When the price approaches the outer bands, it may suggest a potential reversal or breakout.

- Stochastic Oscillator: The Stochastic Oscillator is another momentum indicator that can help traders identify overbought or oversold conditions. Traders can look for divergences or crossovers to signal potential trading opportunities within a range.

Chart Patterns for Range Trading

- Double Top/Bottom: A double top or bottom pattern can indicate a potential reversal within a range. Traders can look for confirmation signals such as a break of the neckline to enter a trade.

- Head and Shoulders: The head and shoulders pattern can also help traders identify potential reversal points within a range. A break of the neckline can signal a change in trend direction.

- Rectangles: Rectangles are common chart patterns that signify a period of consolidation within a range. Traders can look for breakouts or breakdowns from the rectangle pattern to enter trades.

- Triangles: Symmetrical, ascending, and descending triangles can help traders identify potential breakout points within a range. Traders can anticipate a price movement based on the breakout direction of the triangle pattern.

Fundamental Analysis in Range Trading

Fundamental analysis plays a crucial role in range trading as it helps traders understand the underlying economic factors that influence price movements within a range-bound market.

Impact of Economic Events on Range-Bound Markets

- Economic events such as interest rate decisions, GDP reports, and employment data can have a significant impact on range-bound markets.

- For example, a positive employment report can lead to increased consumer spending and economic growth, potentially causing a breakout from a range.

- On the other hand, a central bank’s decision to keep interest rates unchanged may signal stability in the economy, reinforcing the range-bound nature of the market.

Influence of News Releases on Range Trading Decisions

- News releases, such as earnings reports, geopolitical developments, and policy announcements, can trigger volatility in range-bound markets.

- Traders often monitor news releases closely to anticipate any potential market-moving events that could impact their range trading strategy.

- For instance, a sudden geopolitical tension can lead to a shift in market sentiment, causing prices to break out of a range and trend in a new direction.

Backtesting and Optimization of Range Trading Strategies

Backtesting range trading strategies is crucial for traders to assess the viability and profitability of their approach. By analyzing historical data and simulating trades based on the strategy, traders can identify potential weaknesses, strengths, and areas for improvement.

Importance of Backtesting, Range trading strategy in Forex

- Backtesting allows traders to evaluate the performance of their range trading strategy in various market conditions.

- It helps in identifying patterns or trends within the range-bound markets that can be exploited for better trading decisions.

- Traders can assess the risk and reward ratio of their strategy and make necessary adjustments to optimize their approach.

Optimizing a Range Trading Strategy

- Analyze the backtesting results to identify areas of improvement, such as entry and exit points, risk management, and position sizing.

- Consider incorporating additional technical indicators or tools that can enhance the effectiveness of the strategy.

Tools for Backtesting Range Trading Approaches

- MetaTrader 4 and MetaTrader 5: Popular trading platforms that offer built-in backtesting functionalities for range trading strategies.

- TradingView: An online platform that provides advanced charting tools and backtesting capabilities for traders to test their strategies.

- NinjaTrader: A trading platform that allows traders to backtest their range trading strategies and optimize them for better performance.

Mastering the art of range trading in Forex can significantly improve your trading outcomes. By implementing the strategies Artikeld in this guide, you’ll be better equipped to navigate the dynamic world of Forex trading with confidence and precision.

Crypto liquidity plays a significant role in the cryptocurrency market, affecting price volatility and trading volume. Understanding how liquidity works in the crypto space can help traders make more informed decisions and manage risks effectively. To delve deeper into the topic of crypto liquidity, read our article on crypto liquidity.