Kicking off with TradingView for Forex analysis, this platform offers a plethora of features and tools that can revolutionize your approach to Forex trading. From advanced charting tools to a thriving community, TradingView has everything you need to succeed in the Forex market.

Introduction to TradingView for Forex

TradingView is a popular platform among forex traders, offering a wide range of features and tools to enhance the analysis process. Let’s explore the key features and benefits of using TradingView for forex trading.

Key Features of TradingView for Forex Analysis

- Advanced charting tools: TradingView provides a variety of chart types, timeframes, and drawing tools to analyze forex market trends effectively.

- Custom indicators: Traders can create and use custom indicators to develop unique trading strategies based on their analysis.

- Social trading: Users can share ideas, charts, and analysis with the trading community, enabling collaboration and learning from others.

- Real-time data: Access to real-time forex market data allows traders to make informed decisions quickly.

Benefits of Using TradingView for Forex Trading

- User-friendly interface: TradingView’s intuitive platform makes it easy for traders of all levels to navigate and utilize its features.

- Cross-device functionality: Traders can access TradingView on desktop, mobile, and tablet devices, ensuring flexibility and convenience.

- Community insights: By interacting with other traders on the platform, users can gain valuable insights and perspectives on the forex market.

- Backtesting capabilities: Traders can backtest their strategies using historical data to evaluate performance and optimize their trading approach.

How TradingView Enhances the Forex Analysis Process

- Comprehensive tools: TradingView offers a wide range of tools for technical analysis, fundamental analysis, and strategy development, enabling traders to conduct thorough analysis.

- Integration with brokers: Some brokers offer integration with TradingView, allowing traders to execute trades directly from the platform based on their analysis.

- Customization options: Traders can customize their charts, indicators, and alerts to suit their preferences and trading style, enhancing the overall analysis experience.

- Educational resources: TradingView provides educational content and tutorials to help traders improve their skills and knowledge in forex trading.

Charting Tools on TradingView

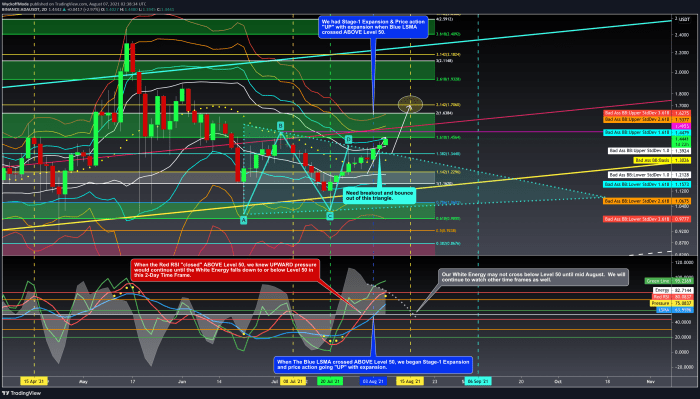

When it comes to Forex analysis on TradingView, traders have access to a wide range of charting tools that can help them make informed decisions. These tools are essential for conducting technical analysis and identifying potential trading opportunities.

Various Charting Tools Available

- Technical Indicators: TradingView offers a variety of technical indicators such as moving averages, Bollinger Bands, MACD, RSI, and more. These indicators help traders analyze price movements and identify trends.

- Drawing Tools: Traders can use drawing tools like trendlines, channels, Fibonacci retracement levels, and shapes to mark key support and resistance levels on the charts.

- Chart Types: TradingView provides different chart types including line, bar, and candlestick charts. Traders can choose the chart type that best suits their analysis.

- Customizable Timeframes: Traders can customize the timeframe of the charts to analyze price movements over different periods, from minutes to months.

Comparison with Other Platforms

TradingView stands out from other platforms due to its user-friendly interface and extensive range of charting tools. While other platforms may offer similar tools, TradingView’s customization options and social networking features make it a popular choice among traders.

Customizing Charts for Forex Analysis, TradingView for Forex analysis

Traders can customize their charts on TradingView by adding multiple indicators, adjusting settings for each indicator, changing chart colors, and saving chart layouts for future use. By tailoring the charts to their preferences, traders can create a personalized analysis environment that suits their trading style.

Indicators and Strategies

When it comes to Forex analysis on TradingView, traders often rely on a variety of indicators and strategies to make informed decisions. These tools help traders identify trends, potential entry and exit points, and overall market sentiment. In this section, we will explore the popular indicators used for Forex analysis on TradingView and discuss how traders can create and backtest strategies using these indicators.

Popular Indicators for Forex Analysis

- Moving Averages: Moving averages are commonly used to identify trends and potential reversals in the Forex market. Traders often look at the crossover of different moving averages to signal entry or exit points.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. Traders use the RSI to determine overbought or oversold conditions in the market.

- Bollinger Bands: Bollinger Bands consist of a middle line (simple moving average) and two outer bands that represent the standard deviation of price movements. Traders use Bollinger Bands to identify volatility and potential price reversals.

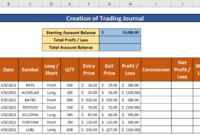

Creating and Backtesting Strategies

- To create a strategy on TradingView, traders can use the built-in Pine Script editor to write custom scripts based on their preferred indicators and criteria.

- Once a strategy is created, traders can backtest it using historical data to see how it would have performed in the past. This helps traders assess the viability and effectiveness of their strategies before implementing them in live trading.

- Traders can also optimize their strategies by adjusting parameters, testing different timeframes, and incorporating risk management principles to improve performance.

Combining Indicators for Effective Strategies

- Traders often combine multiple indicators to create more robust trading strategies. For example, a trader might use a combination of moving averages, RSI, and Bollinger Bands to confirm signals and filter out false trading opportunities.

- By combining different indicators, traders can gain a more comprehensive view of the market and increase the probability of making successful trades.

- It is essential for traders to understand the strengths and limitations of each indicator and how they interact with each other to avoid conflicting signals and confusion.

Community and Social Trading: TradingView For Forex Analysis

The community aspect of TradingView plays a significant role in enhancing Forex analysis by fostering collaboration, idea sharing, and market insights among traders.

Social Trading Features on TradingView

- Trade Ideas: Traders can share their trade ideas, strategies, and analysis on TradingView, allowing others to learn and gain insights.

- Follow Feature: Users can follow top traders and analysts on the platform, replicating their trades or using their analysis to inform their own decisions.

- Comment Section: The interactive comment section enables discussions, feedback, and additional perspectives on trading ideas and analysis.

- Private Messaging: Traders can connect with each other privately to discuss strategies, ask questions, or seek advice.

Benefits for Forex Traders

- Learning Opportunities: By engaging with the TradingView community, traders can learn from experienced professionals, understand different trading styles, and broaden their knowledge base.

- Validation of Ideas: Sharing trading ideas and receiving feedback from other traders can help validate analysis, improve trading strategies, and enhance decision-making.

- Networking: Building connections within the TradingView community can lead to valuable networking opportunities, mentorship, and collaboration on trading projects.

- Social Accountability: Being part of a trading community encourages accountability, discipline, and transparency in trading practices.

Importance of Sharing and Collaborating

- Collective Intelligence: Collaboration within the TradingView community harnesses the collective intelligence of traders worldwide, leading to deeper market insights and innovative trading strategies.

- Diverse Perspectives: By sharing ideas and collaborating with traders from different backgrounds and expertise levels, individuals can gain diverse perspectives and approaches to Forex analysis.

- Continuous Learning: The exchange of knowledge and experiences within the community fosters a culture of continuous learning and improvement among Forex traders.

Mobile Trading with TradingView

Mobile trading has become increasingly popular among Forex traders, enabling them to stay connected to the markets and execute trades on the go. TradingView offers a mobile app that provides a user-friendly interface and a range of features to support Forex analysis and trading. Let’s explore the functionalities, advantages, limitations, and tips for optimizing the TradingView mobile experience for efficient Forex trading.

Functionalities of TradingView’s Mobile App

- Real-time Forex quotes and interactive charts for technical analysis on the go.

- Customizable watchlists and alerts to monitor and react to market movements.

- Access to a wide range of technical indicators and drawing tools for in-depth analysis.

- Ability to place and manage trades directly from the mobile app.

- Synced account settings and layouts between desktop and mobile for seamless transition.

Advantages and Limitations of Using TradingView on Mobile Devices

- Advantages:

- Flexibility to trade and analyze the markets anytime, anywhere.

- Quick access to real-time data and market news for informed decision-making.

- Integration with social trading features for community insights and collaboration.

- Limitations:

- Smaller screen size may limit the visibility of multiple charts and indicators simultaneously.

- Potential for slower execution speed compared to desktop platforms.

- Limited screen real estate may hinder complex analysis and trading strategies.

Tips for Optimizing TradingView Mobile Experience

- Customize your layout and watchlists to prioritize essential information on the mobile app.

- Utilize alerts and notifications effectively to stay informed about market movements and trading opportunities.

- Focus on a few key indicators and tools for efficient analysis on the smaller screen.

- Consider using a stylus for more precise drawing and analysis on touch screens.

- Regularly update the app to access the latest features and improvements for a better trading experience.

In conclusion, TradingView for Forex analysis is a game-changer for traders looking to elevate their strategies and make informed decisions. With a blend of advanced tools, social trading features, and a supportive community, TradingView sets the stage for success in the Forex market. Dive in today and unlock the full potential of your trading journey.

When it comes to investing, many people find themselves torn between Forex trading vs commodities trading. While Forex offers high liquidity and 24-hour trading, commodities can provide a hedge against inflation and geopolitical risks.

If you’re new to the world of trading, understanding Spot Forex trading is crucial. This type of trading involves buying one currency while simultaneously selling another, with the hope of profiting from the exchange rate fluctuations.

Managing digital assets is becoming increasingly important in today’s digital age. From cryptocurrencies to digital securities, digital assets management is essential for individuals and businesses looking to diversify their portfolios.