Forex demo accounts for beginners provide a crucial stepping stone into the world of trading. Let’s explore how these accounts can help new traders hone their skills and navigate the complexities of the Forex market.

Introduction to Forex Demo Accounts

Forex demo accounts are virtual trading accounts provided by brokers to beginner traders. These accounts simulate real trading conditions without the risk of losing actual money. They are crucial for beginners to practice trading strategies, understand market dynamics, and gain confidence before transitioning to live trading.

Benefits of Using a Forex Demo Account

- Zero Risk: With demo accounts, beginners can practice trading without risking any real money.

- Market Understanding: Demo accounts help beginners grasp the intricacies of the Forex market, including how currencies move and factors influencing price changes.

- Strategy Testing: Traders can test different trading strategies in a risk-free environment to see which ones work best for them.

- Platform Familiarization: Demo accounts allow beginners to get acquainted with the trading platform and its features.

How Forex Demo Accounts Help Beginners Learn

- Hands-On Experience: Demo accounts provide a practical way for beginners to apply theoretical knowledge in real-time trading scenarios.

- Risk Management: By experimenting with different strategies and risk management techniques, beginners can learn to protect their capital.

- Psychological Preparation: Trading can be emotionally challenging, and demo accounts help beginners develop the mental discipline required for successful trading.

Setting Up a Forex Demo Account

Creating a Forex demo account is an essential step for beginners to practice trading in a risk-free environment before venturing into the live market. Here are the steps to set up a Forex demo account and the common requirements to consider:

Step-by-Step Guide

- Choose a reputable broker: Research and select a reliable broker that offers demo accounts. Ensure they are regulated and have a user-friendly platform.

- Visit the broker’s website: Go to the broker’s official website and look for the option to open a demo account. This is usually located in the ‘Account Types’ or ‘Open Account’ section.

- Fill out the registration form: Provide your personal details, including name, email address, phone number, and country of residence. Some brokers may require additional information for verification purposes.

- Choose account settings: Select the trading platform you want to use (such as MetaTrader 4 or 5) and set the initial virtual deposit amount. This will mimic the real trading conditions.

- Download the trading platform: Once your demo account is set up, download the trading platform on your computer or mobile device. Log in with the credentials provided by the broker.

- Start trading: Familiarize yourself with the platform, practice placing trades, analyzing charts, and managing risk. Use the virtual funds in your demo account to test different trading strategies.

Common Requirements

- Email address: Most brokers require a valid email address to register for a demo account. This is used for account verification and communication purposes.

- Personal information: You may need to provide personal details such as your name, address, date of birth, and identification documents for KYC (Know Your Customer) verification.

- Internet connection: A stable internet connection is essential for accessing the trading platform and executing trades on your demo account.

- Device: You can use a desktop, laptop, smartphone, or tablet to access your demo account. Ensure your device is compatible with the trading platform.

Choosing a Reliable Broker

- Regulation: Look for brokers regulated by reputable financial authorities, such as the SEC (Securities and Exchange Commission) or FCA (Financial Conduct Authority).

- Trading conditions: Consider factors like leverage, spreads, commission fees, and available trading instruments when choosing a broker for your demo account.

- Customer support: Opt for a broker with responsive customer support to address any issues or queries you may have while using the demo account.

- Educational resources: Check if the broker provides educational materials, webinars, and tutorials to help beginners learn about forex trading.

Navigating a Forex Demo Account Platform: Forex Demo Accounts For Beginners

Navigating a Forex demo account platform is crucial for beginners to practice trading effectively. Understanding the key features of the platform and how to utilize them can help in gaining valuable experience without risking real money.

Key Features of a Forex Demo Account Platform

- Real-time Market Data: Demo platforms provide access to real-time market data, allowing beginners to analyze price movements and trends.

- Trading Tools: Platforms offer various trading tools such as technical indicators, charting options, and risk management features to help users make informed decisions.

- Order Types: Users can practice placing different types of orders like market orders, limit orders, and stop orders to understand how they work.

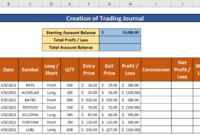

- Account History: The platform keeps a record of all trades made, enabling users to review their performance and learn from past mistakes.

Comparison of Different Forex Demo Account Platforms, Forex demo accounts for beginners

- MetaTrader 4 (MT4): A popular platform known for its user-friendly interface and extensive charting capabilities.

- MetaTrader 5 (MT5): Offers advanced features like more timeframes, additional order types, and an economic calendar for fundamental analysis.

- cTrader: Known for its fast execution speeds and customizable interface, ideal for traders looking for a more personalized experience.

Tips for Navigating the Platform Effectively

- Start with a Basic Understanding: Familiarize yourself with the platform’s layout, tools, and functions before executing trades.

- Practice Regularly: Make use of the demo account daily to hone your skills and test different strategies without the fear of losing money.

- Set Realistic Goals: Define clear objectives for each trading session and evaluate your performance to track progress over time.

- Utilize Educational Resources: Most platforms offer tutorials, webinars, and guides to help beginners learn how to navigate the platform effectively.

Practicing Trading with a Forex Demo Account

Practicing trading with a Forex demo account is a crucial step for beginners to gain experience and confidence in the forex market. It allows traders to test different strategies, familiarize themselves with trading platforms, and understand the dynamics of the market without risking real money.

Setting Trading Goals and Objectives

Before starting to practice trading on a Forex demo account, beginners should set clear goals and objectives. This helps in defining a purpose for the practice sessions and allows traders to track their progress. Some common trading goals for beginners include:

- Learning how to place different types of orders

- Understanding technical analysis indicators

- Developing a trading strategy

- Managing risk effectively

Examples of Trading Exercises

To effectively practice trading on a Forex demo account, beginners can perform a variety of exercises such as:

- Executing different types of orders like market orders, limit orders, and stop orders

- Practicing technical analysis by identifying trends, support and resistance levels, and chart patterns

- Testing different trading strategies, such as scalping, day trading, or swing trading

- Implementing risk management techniques by setting stop-loss and take-profit levels

In conclusion, Forex demo accounts offer beginners a risk-free environment to learn and practice trading strategies. By utilizing these accounts effectively, new traders can build a strong foundation for their future trading endeavors.

When it comes to Forex trading, having the right tools can make all the difference. One essential tool for traders is the use of Forex charting tools , which help in analyzing market trends and making informed decisions. Another key aspect of successful trading is having effective strategies in place. Traders looking to engage in day trading can benefit from learning about day trading strategies Forex to maximize their profits.

Additionally, utilizing the best Forex scalping indicators can help traders identify entry and exit points with precision.

When it comes to Forex trading, having the right tools can make all the difference. One of the most essential tools for traders is Forex charting tools , which provide valuable insights into market trends and patterns. These tools enable traders to analyze price movements and make informed decisions.

Successful day trading in the Forex market requires a solid strategy. Traders who are looking to maximize their profits often turn to day trading strategies Forex for guidance. These strategies help traders identify opportunities and execute trades quickly and effectively.

For traders who prefer a fast-paced approach, scalping can be a profitable strategy. Utilizing the best Forex scalping indicators is crucial for success in this trading style. These indicators help traders spot trends and make quick decisions to capitalize on small price movements.