Fibonacci tools for Forex trading sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

As traders delve into the world of Fibonacci tools, a realm of intricate patterns and strategic analysis unfolds, guiding them through the complexities of price movements in the Forex market.

What are Fibonacci tools in Forex trading?

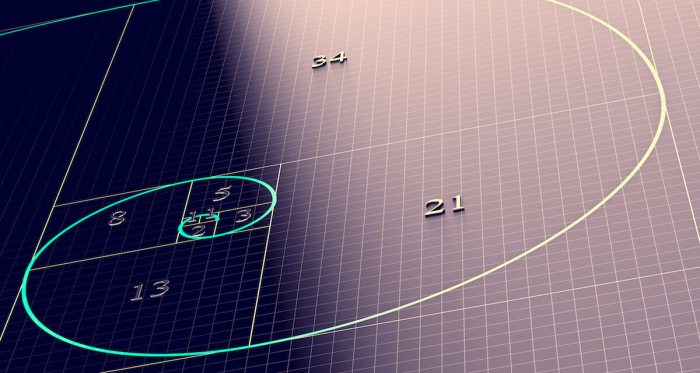

Fibonacci tools in Forex trading are technical analysis tools based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. These tools are used to identify potential levels of support and resistance, as well as to determine possible price retracement levels in the market.

Types of Fibonacci tools

- Fibonacci Retracement: This tool is used to identify potential support and resistance levels based on the Fibonacci sequence. Traders use this tool to predict possible retracement levels after a price movement.

- Fibonacci Extensions: These tools are used to identify potential profit targets or extension levels beyond the initial price movement. Traders often use Fibonacci extensions to set exit points for their trades.

- Fibonacci Fans: This tool consists of diagonal lines that are used to identify potential areas of support and resistance. Traders use Fibonacci fans to gauge the strength of a trend and potential reversal points.

Calculation and Application of Fibonacci Retracement Levels

Fibonacci retracement levels are calculated by identifying a significant price movement (swing high and swing low) and applying the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%) to determine potential retracement levels. Traders then use these levels to anticipate where the price might reverse or continue its trend.

Significance of Fibonacci tools in analyzing price movements

Fibonacci tools are widely used by Forex traders to help identify potential support and resistance levels, determine entry and exit points, and manage risk effectively. The levels provided by Fibonacci tools can act as self-fulfilling prophecies, as many traders base their trading decisions on these key levels.

Fibonacci retracement levels

Fibonacci retracement levels are key tools used in Forex trading to identify potential support and resistance areas, set profit targets, and determine stop-loss levels. These levels are based on the Fibonacci sequence and ratios and are widely used by traders to make informed decisions.

Primary Fibonacci retracement levels

- The primary Fibonacci retracement levels used in Forex trading are 23.6%, 38.2%, 50%, 61.8%, and 100%.

- These levels are derived from the Fibonacci sequence and are believed to represent key areas where price could reverse or consolidate.

Using Fibonacci retracement levels, Fibonacci tools for Forex trading

- Traders use Fibonacci retracement levels to identify potential support and resistance areas in the market.

- For example, if a currency pair is in an uptrend and retraces to the 50% Fibonacci level, traders may see this as a potential area of support to enter a long trade.

Setting profit targets and stop-loss levels

- Traders use Fibonacci retracement levels to set profit targets by identifying key levels where price could reverse or encounter resistance.

- Stop-loss levels can also be placed below or above Fibonacci retracement levels to manage risk and protect capital in case the market moves against the trade.

Combining with other technical indicators

- It is important for traders to combine Fibonacci retracement levels with other technical indicators such as moving averages, trend lines, and oscillators to confirm potential reversal areas.

- By using multiple indicators in conjunction with Fibonacci retracement levels, traders can increase the probability of making successful trades.

Fibonacci extensions

Fibonacci extensions are a tool used in Forex trading to predict potential price targets beyond the usual Fibonacci retracement levels. These extensions are based on the Fibonacci sequence and are calculated by extending the trend line beyond the initial swing high or low.

Role of Fibonacci extensions in Forex trading

Fibonacci extensions play a crucial role in helping traders identify possible price levels where a currency pair may reverse or continue its trend. By projecting potential price targets based on the Fibonacci ratios, traders can better anticipate market movements and make informed trading decisions.

- Traders can use Fibonacci extensions to set profit targets for their trades, helping them take profits at key levels.

- These extensions can also be used to identify areas of potential support or resistance, where price may stall or reverse.

- By incorporating Fibonacci extensions into their analysis, traders can add another layer of confluence to their trading strategy, increasing the probability of successful trades.

Comparison with Fibonacci retracement levels

While Fibonacci retracement levels help traders identify potential reversal points within a trend, Fibonacci extensions are used to project price targets beyond the current trend. Retracement levels are typically used to enter trades or adjust stop-loss levels, while extensions can guide traders in setting profit targets and identifying potential trend continuation levels.

- Fibonacci retracement levels are applied during a pullback in the trend, while Fibonacci extensions are used to forecast price levels beyond the previous swing high or low.

- Both tools are based on the Fibonacci ratios, but they serve different purposes in the trading process.

Incorporating Fibonacci extensions in trading strategies

Traders can incorporate Fibonacci extensions into their trading strategies by identifying key swing points in the market and applying the Fibonacci extension tool to project potential price targets. By combining Fibonacci extensions with other technical indicators and price action analysis, traders can create a comprehensive trading plan with clear entry and exit points.

- For example, a trader may use Fibonacci extensions to set profit targets for a long trade by projecting key extension levels above the previous swing high.

- Traders can also use Fibonacci extensions in conjunction with other tools like moving averages or trend lines to confirm potential price targets and increase the accuracy of their forecasts.

Fibonacci fans and arcs: Fibonacci Tools For Forex Trading

Fibonacci fans and arcs are additional tools used in Forex trading to complement the analysis provided by Fibonacci retracement and extension levels. These tools are based on the Fibonacci sequence and ratios, aiming to identify potential trendlines, support/resistance levels, and predict price movements and trend reversals.

Fibonacci Fans

Fibonacci fans consist of trendlines drawn from a selected high or low point, extending outwards at various Fibonacci levels. These fan lines are used to identify potential areas of support and resistance in the market. Traders often look for price action near these fan lines to make trading decisions. The steepness of the fan lines can also indicate the strength of a trend.

- Fibonacci fans help traders visualize potential areas where price may encounter obstacles or change direction.

- Traders can use Fibonacci fans in conjunction with other technical indicators to confirm trading signals.

- Adjusting the starting point of the fan can provide different perspectives on potential support and resistance levels.

Fibonacci Arcs

Fibonacci arcs are curved lines drawn between a selected high or low point and other Fibonacci levels, forming a semi-circle or arc shape. These arcs are used to predict potential future price movements and trend reversals based on the principle of geometric angles and Fibonacci ratios.

- Fibonacci arcs can help traders anticipate where price might find support or resistance in the future.

- The curvature of the arcs can indicate the strength of a trend or potential turning points in the market.

- Traders often look for price action near the arcs to confirm their analysis and make trading decisions.

By combining Fibonacci fans, arcs, retracement, and extension levels, traders can gain a more comprehensive view of the market dynamics and make well-informed trading decisions. These Fibonacci tools provide a systematic approach to analyzing price movements and identifying key levels for potential entry and exit points in the market.

In conclusion, Fibonacci tools for Forex trading serve as a powerful ally for traders seeking to decipher the cryptic language of market trends and price action, paving the way for informed decision-making and enhanced profitability in the ever-evolving landscape of foreign exchange trading.

When it comes to trading in the Forex market, understanding momentum trading strategies is crucial. By utilizing Momentum trading strategies in Forex , traders can capitalize on the direction of price movements to make profitable trades. These strategies involve analyzing the speed and strength of price movements to determine the best entry and exit points. By incorporating momentum indicators and technical analysis, traders can make informed decisions and improve their chances of success in the Forex market.

When it comes to trading in the Forex market, understanding momentum trading strategies is essential. By utilizing Momentum trading strategies in Forex , traders can capitalize on the market’s directional strength. These strategies involve identifying trends and using indicators to gauge the momentum of a particular currency pair. By following these strategies, traders can make informed decisions and potentially increase their profits.