Forex trading for beginners sets the stage for new traders to enter the exciting world of currency trading, offering insights and tips to navigate this complex market with confidence.

Exploring the fundamental concepts, strategies, and tools essential for success, this guide equips beginners with the knowledge needed to make informed trading decisions.

Understanding Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in the global market. Unlike stock trading, which focuses on shares of companies, Forex trading deals with the exchange rates between different currencies.

Major Currency Pairs in the Forex Market

In Forex trading, the most commonly traded currency pairs include:

- Euro (EUR) / US Dollar (USD) – EUR/USD

- US Dollar (USD) / Japanese Yen (JPY) – USD/JPY

- British Pound (GBP) / US Dollar (USD) – GBP/USD

- Australian Dollar (AUD) / US Dollar (USD) – AUD/USD

Leverage in Forex Trading

Leverage is a tool that allows traders to control larger positions with a smaller amount of capital. It is a double-edged sword that can amplify both profits and losses in Forex trading. For beginners, understanding how leverage works is crucial as it can significantly impact their trading decisions.

Setting Up a Forex Trading Account: Forex Trading For Beginners

Opening a Forex trading account is the first step for beginners looking to enter the world of currency trading. It involves a few key steps that are essential to get started in the Forex market.

Steps to Open a Forex Trading Account

- Choose a reputable Forex broker: Research and select a regulated broker with a good reputation in the industry.

- Complete the registration process: Fill out the necessary forms and provide required documents for identity verification.

- Deposit funds: Fund your trading account with an initial deposit to start trading.

- Download the trading platform: Install the trading platform provided by your broker to execute trades.

- Start trading: Begin trading by analyzing the market and placing trades through the platform.

Types of Forex Trading Accounts for Beginners, Forex trading for beginners

- Standard Account: Suitable for beginners with a basic understanding of Forex trading, offering regular trading conditions.

- Mini Account: Ideal for new traders with limited capital, allowing smaller trade sizes and reduced risk.

- Demo Account: A practice account that simulates real market conditions for beginners to learn and practice trading strategies without risking real money.

Importance of Choosing a Regulated and Reputable Forex Broker

Choosing a regulated and reputable Forex broker is crucial for beginners to ensure the safety of their funds and the integrity of their trading activities. Regulated brokers are required to adhere to strict guidelines and standards set by financial authorities, providing a level of protection for traders. Additionally, reputable brokers offer reliable trading platforms, competitive spreads, and quality customer support, enhancing the overall trading experience for beginners.

Fundamental Concepts in Forex Trading

Understanding the fundamental concepts in forex trading is crucial for beginners to grasp the basics of how the foreign exchange market operates.

Currency Pairs, Base Currency, and Quote Currency

In forex trading, currencies are always traded in pairs. The first currency listed in the pair is the base currency, while the second currency is the quote currency. For example, in the EUR/USD pair, the Euro is the base currency, and the US Dollar is the quote currency. Understanding this relationship is essential for determining the value of one currency relative to another.

Factors Influencing Exchange Rates

Several factors can influence exchange rates in the forex market, including economic indicators, geopolitical events, central bank policies, and market sentiment. Economic data such as GDP growth, inflation rates, and employment figures can all impact the value of a currency. Additionally, political instability, trade agreements, and interest rate decisions can also affect exchange rates.

Significance of Economic Indicators and News Events

Economic indicators and news events play a significant role in forex trading as they can cause volatility in the market. Traders closely monitor economic reports like Non-Farm Payrolls, Consumer Price Index (CPI), and Gross Domestic Product (GDP) to gauge the health of an economy and make informed trading decisions. News events such as central bank announcements, geopolitical tensions, and trade negotiations can also impact currency prices. Staying informed about these developments is crucial for successful forex trading.

Developing a Forex Trading Strategy

Developing a solid trading strategy is crucial for success in the Forex market, especially for beginners. A trading strategy helps traders make informed decisions based on analysis and research, rather than emotions. Here are some tips on how beginners can develop a trading strategy that suits their risk tolerance.

Types of Trading Strategies

- Day Trading: Involves opening and closing trades within the same day, taking advantage of small price movements. Requires close monitoring of the market throughout the day.

- Swing Trading: Involves holding positions for a few days to a few weeks to capitalize on larger price movements. Less time-intensive compared to day trading.

- Position Trading: Involves holding positions for weeks, months, or even years, based on long-term trends. Requires patience and a broader perspective on the market.

Risk Management and Stop-Loss Orders

Risk management is a critical aspect of any trading strategy, as it helps protect capital and minimize losses. Setting stop-loss orders is a key risk management tool in Forex trading. These orders automatically close a trade when the price reaches a certain level, preventing further losses beyond a predetermined point.

It is essential to set stop-loss orders at levels that align with your risk tolerance and trading strategy.

Technical Analysis in Forex Trading

Technical analysis is a method used by Forex traders to evaluate and forecast price movements based on historical data. This analysis focuses on market trends, price patterns, and other factors that can help traders make informed decisions.

Common Technical Indicators

Technical indicators are mathematical calculations based on price, volume, or open interest of a currency pair. These indicators help traders identify trends, momentum, and potential reversal points in the market. Some common technical indicators used in Forex trading include:

- Simple Moving Average (SMA): A trend-following indicator that smooths out price data to identify the direction of a trend.

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions.

- Bollinger Bands: Volatility bands placed above and below a moving average. They help traders identify potential overbought or oversold levels.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Chart Patterns for Trading Decisions

Chart patterns are formations that appear on price charts and can indicate potential market reversals or continuations. Traders use these patterns to make decisions on when to enter or exit trades. Some common chart patterns in Forex trading include:

- Head and Shoulders: A reversal pattern that indicates a possible trend change from bullish to bearish or vice versa.

- Double Top/Bottom: Reversal patterns that signal a potential trend reversal after a significant price movement.

- Flags and Pennants: Continuation patterns that suggest a temporary pause in the current trend before the price continues in the same direction.

- Triangles: Continuation patterns that show a tightening range of price movements, indicating an impending breakout.

Practicing with Demo Accounts

Practicing with demo accounts is an essential step for beginners in Forex trading to gain valuable experience and confidence before risking real money in the market. Demo accounts simulate real trading conditions without any financial risk, allowing traders to test their strategies and understand the platform.

Benefits of Using Demo Accounts

- Helps beginners understand the basics of Forex trading without financial risk.

- Allows traders to test different trading strategies and techniques.

- Provides a realistic experience of the market dynamics and price movements.

- Helps in familiarizing with the trading platform and tools available.

Tips for Effective Practice with Demo Accounts

- Set up the demo account with an amount similar to what you plan to start with in a real account.

- Treat the demo account as if it were real money to practice disciplined trading.

- Experiment with different trading strategies and analyze the outcomes.

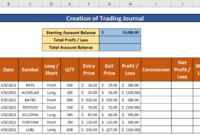

- Keep a trading journal to track your progress and learn from your mistakes.

- Use the demo account to understand risk management techniques and position sizing.

Importance of Demo Accounts for Beginners

Using demo accounts can significantly benefit beginners in Forex trading by providing a risk-free environment to practice and refine their skills. It helps traders gain the necessary experience and confidence to navigate the complexities of the Forex market before committing real funds. Through consistent practice on demo accounts, beginners can develop a solid foundation and improve their trading performance over time.

In conclusion, Forex trading for beginners serves as a valuable resource for those looking to kickstart their trading career, emphasizing the importance of education, practice, and sound decision-making in the Forex market.

When it comes to Forex trading, having the right indicators can make all the difference. If you’re looking for the best Forex scalping indicators, look no further. Check out our comprehensive list of Best Forex scalping indicators that can help you maximize your profits in the fast-paced world of scalping.

Understanding how to use indicators in Forex can significantly improve your trading strategy. By incorporating the right indicators, you can make informed decisions and increase your chances of success. Learn more about how to use indicators in Forex effectively to enhance your trading experience.

Spot Forex trading is a popular method among traders due to its simplicity and accessibility. If you’re new to this type of trading, it’s essential to understand the basics. Dive into the world of Spot Forex trading and get Spot Forex trading explained to kickstart your trading journey with confidence.