Kicking off with Major currency pairs in Forex, this article delves into the fundamental aspects of trading with major currency pairs, providing valuable insights for both novice and experienced traders alike. From understanding the significance of these pairs to exploring trading strategies, this comprehensive guide covers it all.

Overview of Major Currency Pairs

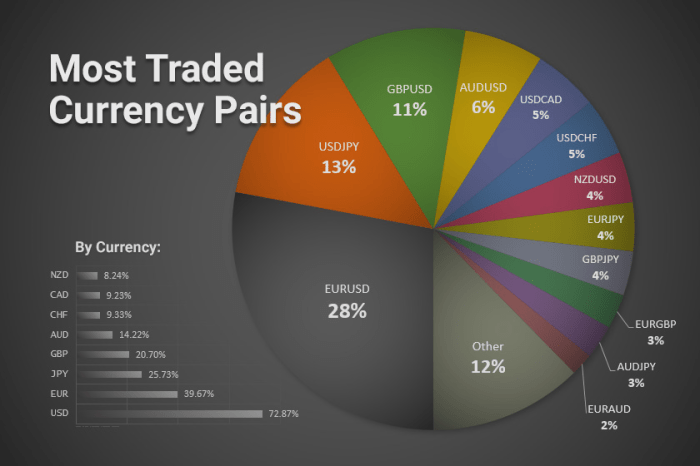

Major currency pairs are the most traded pairs in the Forex market and consist of currencies from the world’s largest economies. These pairs are highly liquid and offer lower spreads, making them attractive to traders.

Looking ahead, the future of cryptocurrency holds immense potential for innovation and disruption across various industries. From decentralized finance to non-fungible tokens, the possibilities are endless. As governments, businesses, and individuals continue to explore the benefits of blockchain technology and digital currencies, the future of cryptocurrency remains a topic of great interest and debate. Stay tuned as the world of cryptocurrency continues to evolve and shape the future of finance.

List of Major Currency Pairs

- Euro/US Dollar (EUR/USD)

- US Dollar/Japanese Yen (USD/JPY)

- British Pound/US Dollar (GBP/USD)

- Australian Dollar/US Dollar (AUD/USD)

- US Dollar/Canadian Dollar (USD/CAD)

- US Dollar/Swiss Franc (USD/CHF)

Significance of Major Currency Pairs

Major currency pairs are crucial for traders as they represent the most liquid and widely traded currencies in the Forex market. These pairs provide ample opportunities for trading due to their high trading volumes and tight spreads.

As investors and enthusiasts closely monitor the ups and downs of the market, keeping track of cryptocurrency prices has become a daily routine for many. The volatile nature of digital assets means that prices can fluctuate dramatically in a short period of time, making it essential for traders to stay informed and react quickly to market changes. Understanding the factors that influence cryptocurrency prices is key to making informed investment decisions and navigating the ever-changing landscape of the digital currency market.

Most Traded Currency Pairs and Characteristics

| Currency Pair | Characteristics |

|---|---|

| EUR/USD | Known as the “Fiber,” it is the most traded currency pair in the Forex market with tight spreads and high liquidity. |

| USD/JPY | Referred to as the “Gopher,” it is highly influenced by the economic policies of Japan and the United States. |

| GBP/USD | Known as the “Cable,” it is affected by economic developments in the UK and the US, making it volatile. |

| AUD/USD | Called the “Aussie,” this pair is influenced by commodity prices and the overall risk sentiment in the market. |

| USD/CAD | Known as the “Loonie,” it is sensitive to oil prices due to Canada’s significant oil exports. |

| USD/CHF | Referred to as the “Swissie,” this pair is influenced by safe-haven flows and economic data from Switzerland and the US. |

Characteristics of Major Currency Pairs

Major currency pairs in the forex market exhibit distinct characteristics that traders need to be aware of in order to make informed decisions. Let’s delve into some key aspects that differentiate these pairs.

Liquidity Comparison

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant impact on its price. In the forex market, major currency pairs are known for their high liquidity levels due to the large trading volumes they command. Among the major currency pairs, the most liquid ones include EUR/USD, USD/JPY, and GBP/USD. Traders often prefer these pairs as they offer tighter spreads and smoother price movements.

Volatility Levels

Volatility in the forex market refers to the degree of price fluctuations a currency pair experiences over a certain period of time. Different major currency pairs exhibit varying levels of volatility based on factors such as economic indicators, geopolitical events, and market sentiment. For example, pairs like GBP/USD and USD/JPY tend to be more volatile compared to EUR/USD. Traders need to factor in volatility when devising their trading strategies to manage risk effectively.

When it comes to the future of cryptocurrency, many experts believe that the technology behind it will continue to evolve and shape the financial landscape. One of the key innovations driving this evolution is the rise of smart contracts in crypto. These self-executing contracts are built on blockchain technology and have the potential to revolutionize how agreements are made and enforced in the digital world.

As a result, the future of cryptocurrency is closely tied to the adoption and development of smart contract technology.

Impact of Geopolitical Events

Geopolitical events can have a profound impact on major currency pairs as they influence market sentiment and risk appetite. For instance, political instability, trade tensions, or economic crises in a country can lead to sharp movements in its currency pairs. Traders closely monitor geopolitical developments and news announcements to anticipate potential shifts in currency values and adjust their trading positions accordingly.

Relationship Between Major Currency Pairs

When it comes to major currency pairs in the forex market, there is a strong relationship between them that can impact each other’s movements. Understanding these correlations is crucial for successful trading.

Correlation Among Major Currency Pairs

- Major currency pairs are often correlated due to various factors such as economic indicators, geopolitical events, and market sentiment.

- For example, the EUR/USD and GBP/USD pairs are positively correlated, meaning they tend to move in the same direction.

- Conversely, the USD/JPY pair is negatively correlated with the EUR/USD, meaning they move in opposite directions.

Cross Currency Pairs and Their Relation to Major Pairs

- Cross currency pairs do not involve the US dollar and are derived from major currency pairs.

- For example, the EUR/JPY is a cross currency pair that is related to the EUR/USD and USD/JPY pairs.

- Changes in major currency pairs can influence cross currency pairs, but the impact may not always be direct due to the absence of the US dollar.

Impact of Changes in One Major Currency Pair on Others, Major currency pairs in Forex

- Changes in one major currency pair can have a ripple effect on other pairs, especially those that are correlated.

- For instance, if there is a significant economic announcement affecting the USD, it can impact all USD pairs, including the EUR/USD and GBP/USD.

- Traders need to pay attention to these interrelationships to anticipate potential movements and make informed trading decisions.

Trading Strategies for Major Currency Pairs: Major Currency Pairs In Forex

When it comes to trading major currency pairs in the Forex market, there are several common strategies that traders use to capitalize on price movements. Understanding these strategies and the importance of technical analysis can help beginners trade more effectively.

Common Trading Strategies:

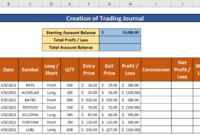

- Day Trading: This strategy involves opening and closing positions within the same trading day to take advantage of short-term price movements.

- Swing Trading: Traders using this strategy aim to capture medium-term trends by holding positions for several days to weeks.

- Trend Following: Traders identify and follow the direction of a prevailing trend, buying when the market is bullish and selling when it’s bearish.

- Range Trading: This strategy involves identifying and trading within a range-bound market, buying at support levels and selling at resistance levels.

Importance of Technical Analysis:

Technical analysis plays a crucial role in trading major currency pairs as it helps traders analyze historical price data, identify patterns, and make informed trading decisions based on price charts and indicators. By using technical analysis, traders can better predict future price movements and improve their trading strategies.

Tips for Beginners:

- Start with a demo account to practice trading major currency pairs without risking real money.

- Focus on a few major currency pairs to gain a deeper understanding of their behavior and price movements.

- Stay updated on economic events and news that could impact major currency pairs to make informed trading decisions.

- Use stop-loss orders to manage risk and protect your capital from significant losses.

In conclusion, mastering the dynamics of major currency pairs is essential for achieving success in the Forex market. By staying informed about the latest trends and developments, traders can make well-informed decisions and navigate the complexities of currency trading with confidence.